A Simplistic Guide to Small Business Accounting

Whether you’re launching your first business or you’re a seasoned pro, small business accounting can feel overwhelming. Your business finances impact your decision making, budgeting, financial planning and taxes so it’s important that your books are accurate.

Before we jump into today's topic, let’s cover some accounting terminology:

Revenue: The amount of money or income generated by a company’s normal business operations before any expenses are deducted. Revenue is also often referred to as Sales. Some examples of revenue are completed jobs, service calls, maintenance contracts and product sales.

Expense: The money a business spends to operate, provide services, or generate revenue. Some examples of expenses are rent and utilities, payroll, software expenses (like Jobber or QuickBooks), or small tools and equipment (typically under $2,500).

Profit: Is the money the business keeps after paying all expenses.

Profit = Revenue - Expenses

Asset: Something your business owns that has value and can help the business make money. This can be work trucks and equipment, cash in the bank, accounts receivable or larger tools and machinery.

Liability: Something that the business owes - money or obligations the business is responsible for paying. This can be unpaid bills, payroll taxes due, business loans or customer deposits you haven’t earned yet.

Equity: is the value of your business after subtracting what the business owes (liabilities) vs what the business owns (assets). Equity might include cash invested, ownership stake, vehicles or equipment fully owned or profits kept in the business.

Accounts Receivable: The amount of money customers owe the business but has not yet been collected. This might include unpaid customer invoices, service contracts billed but not collected or completed jobs that have not yet been paid for.

Accounts Payable: The amount of money the business owes others. This might include supplier invoices, utilities not yet paid, equipment rental charges or bills from subcontractors.

Now that we have covered some basic accounting terminology, let’s see how they are used in financial statements.

Why You Need to Understand Your Financial Statements

Financial statements are important because they show the financial activities and condition of a business over a specific period of time. Financial statements are very important to business owners for three reasons:

Make Informed Decisions: Your financial data is one of the most powerful tools you have for making smart, informed choices in your business.

Know what's working (and what's not): Every business has areas that are thriving and others that need attention. Reviewing your financials helps you pinpoint both, so you know where to double down and where to adjust.

Plan for the future: To be able to plan for the future, you have to understand what is happening today. If you don't understand your financials then you don't understand your business and you are flying blind.

Taxes: Accurate financial reports are needed for you and/or your business to file taxes. Statements help the tax preparer identify deductions and avoid overpaying.

Financing: If your business needs equipment financing, loan or a credit line, lenders will ask for financial statements.

The 3 Financial Statements you Need to Know:

Income statement (profit & Loss or P&L)

Balance Sheet

Statement of Cash Flows

Here's a breakdown of each:

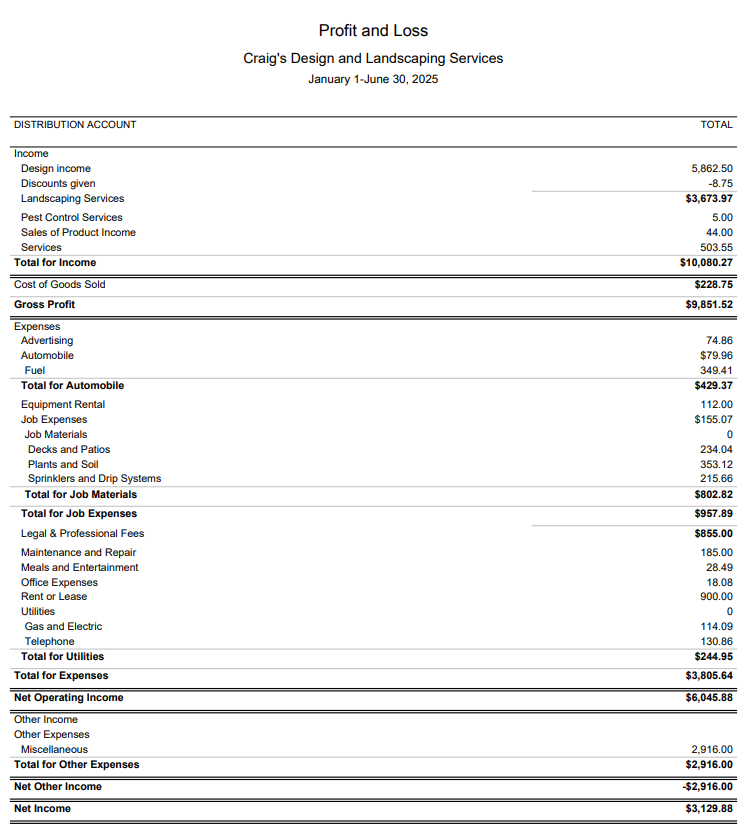

Income Statement or Profit and Loss

This is the most straight forward and most reviewed report out of the three.

The P&L report shows a business’s revenues, costs, and expenses over a specific period. The primary goal of this report is to show whether the business made a profit or incurred a loss during that time frame.

The report will list revenue at the top, costs and expenses in the middle and the profit or loss will be at the bottom. Start at revenue and deduct all the other costs and expenses to arrive at net income.

The report itself has 7 main componets:

Revenue

Cost of Good Solds Sold (is referred to as "cost of sales" in service businesses)

Gross profit

Operating Expenses

Operating Income

Other Income/Expenses

Net Income

It’s important for small businesses owners review their P&L monthly. It gives information and insights into how the business is performing so you can make smart decisions.

Income Statement or Profit and Loss

This is the most straight forward and most reviewed report out of the three.

The P&L report shows a business’s revenues, costs, and expenses over a specific period. The primary goal of this report is to show whether the business made a profit or incurred a loss during that time frame.

The report will list revenue at the top, costs and expenses in the middle and the profit or loss will be at the bottom. Start at revenue and deduct all the other costs and expenses to arrive at net income.

The report itself has 7 main componets:

Revenue

Cost of Good Solds Sold (is referred to as "cost of sales" in service businesses)

Gross profit

Operating Expenses

Operating Income

Other Income/Expenses

Net Income

It’s important for small businesses owners review their P&L monthly. It gives information and insights into how the business is performing so you can make smart decisions.

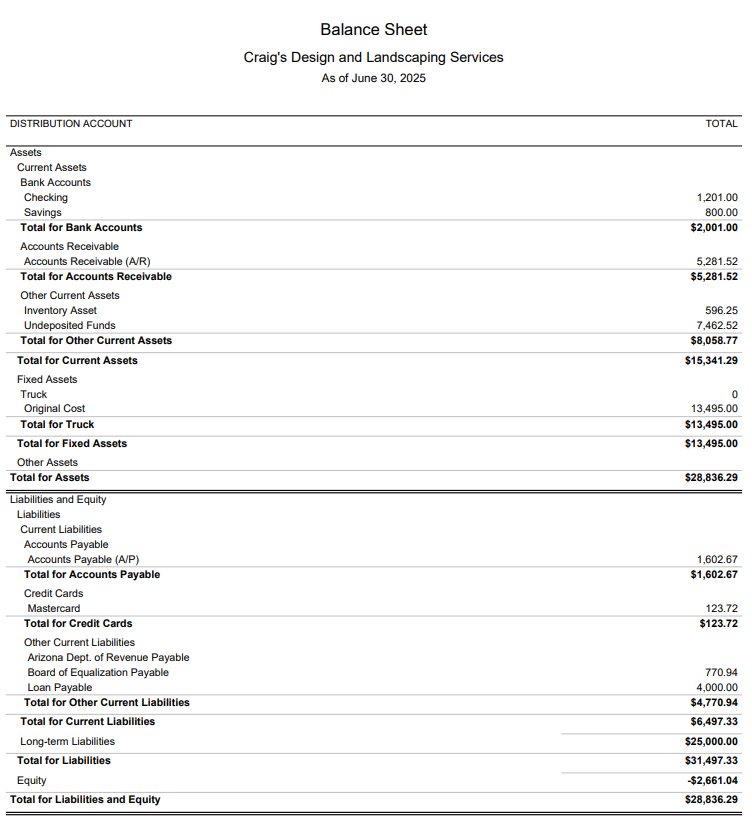

Balance Sheet

The Balance Sheet is a financial statement that shows a business’s overall financial position. It gives a snapshot of what the business owns (assets), owes (liabilities) and what’s left over (owner’s equity) at a specific date in time.

Unlike the P&L, the balance sheet shows the company’s financial position for one specific day rather than a date range. For the best results, balance sheets are typically ran for the last day in the month, quarter or year.

Smaller businesses with no employees or side hustles don’t need to check the balance sheet as much as it is simple and typically doesn’t change much. As the business grows owners will need to include the balance sheet in their reviews for strategic planning.

The balance sheet is divided into two parts that must balance each other out.

The equation is: Assets = Liabilities + Equity

Asset Examples:

Cash

Buildings

Land

Inventory

Large tools or Machinery

Patents

Goodwill

Liability Examples:

Equipment and Vehicle Loans

Credit card debt

Long-term leases

Short-term credit lines

Sales tax owed

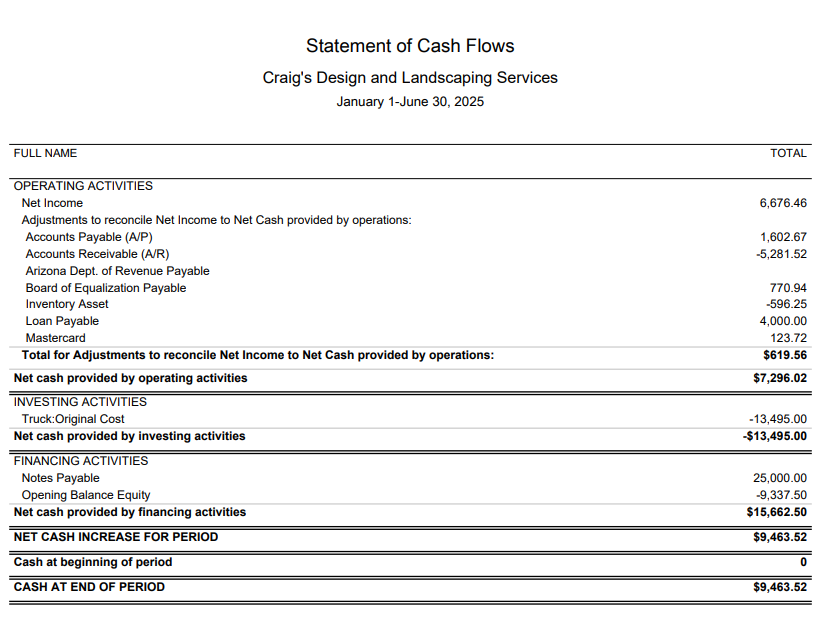

Statement of Cash Flow

This report is generally the least used by small business owners but is still important. The statement of cash flow shows how cash moves in and out of the business over a specific time. It helps understand how well your business generates cash to pay bills, fund operations and invest in growth.

It’s divided into three sections:

Operating Cashflow

Investing Cashflow

Financing Cashflow

This Financial statement is important because it shows cash inflows and outflows that wouldn’t be included in the P&L.

An example of this would be the purchase of a company vehicle or large piece of equipment. A vehicle or large piece of equipment is considered an asset so the purchase and related loan payments would be captured in the statement of cash flows and balance sheet. Even though it is a cash expense at the time of purchase, it is not expensed on the P&L all at once.

Operating Activities Example:

Cash paid to suppliers

Cash received from customers

Cash paid to employees

Cash paid for taxes

Investing Activities Example:

Cash paid for purchasing equipment

Cash received from selling equipment

Financing Activities Example:

Cash received from issuing shares

Cash paid for repurchasing shares

*Note: Financing Activities are only subject to S-Corps and C-Corps

Tracking Business Transactions and documentation

Tracking business transactions has to be done at least once a year for tax purposes. You will need to know total revenues, total expenses by category and total profit.

It’s standard practice to import and categorize transactions and report financial monthly, although businesses just starting out or side-hustle with low volume of transaction activity can do it less frequently (quarterly or even annually in some cases).

Be sure to have separate business bank and credit card accounts used solely for business transactions. Intermingling business with personal transactions makes it difficult to track true business performance, can result in missed deductions coming tax season and can weaken legal protection.

Businesses also need to keep proper documents and support for all business transactions to prove they are valid deductions in case of an IRS audit. If you get caught in an IRS audit they can disallow your deductions and you will have to pay the difference plus penalties and interest, which can add up quickly.

Here are some of the following documents that help prove business deductions:

Bank and credit card statements

Customer invoices and payments

Bills

Receipts

Sales Receipts

Payroll support

1099 Forms

Cancelled Checks

If you are unsure, scan the document and save it in a central location separated by tax year. Even if you are scanning and uploading these to a cloud location, I recommend keeping the physical copy as well.

There is also receipt management software that manages this very well. QuickBooks Online and Expensify are solid options as software solutions if you don’t want to do this manually.

Bonus Tip: At Swanson CFO we help manage this for our clients by having a dedicated portal that receipts can be uploaded to that automatically imports to the accounting file, essentially automating the process.

Completing your Monthly Bookkeeping

Set up Accounting Software

For starters you will need to get a subscription to an accounting software. For service-based business owners I only recommend QuickBooks Online. They are currently the gold standard for bookkeeping software and can integrate with other third-party platforms like Jobber and Gusto. These integrations make streamlining processes much easier. It will take some time, but you can teach yourself how to use the software. QuickBooks has an abundance of resources to help users learn to navigate their platform.

There is other bookkeeping software out there, but most don’t integrate with third party platforms. If you are adamant about not using QuickBooks, Xero is the best alternative. It has many of the same integrations and is a slightly cheaper option but is lacking in areas that QuickBooks does well.

Set up a customized chart of accounts

A customized chart of accounts makes reading your financials 10 times easier.

A chart of accounts typically is divided into 5 main account types:

Assets

Liabilities

Revenue

Expenses

Equity

Customize the account list to make sure it fits the needs of the business. Make sure to update and review regularly.

Organize your financial Records

You need to have clear information to know where you stand, as well as what and what not to focus on.

1. Get a QuickBooks Online subscription

2. Record all transactions and track all your records in QuickBooks (income, expenses, bank deposits, etc.)

3. Review and update transactions weekly. On a monthly basis reconcile all transactions as well as create financial reports. These reports should be reviewed at least monthly. Annually, prepare reports for comprehensive review of years performance and tax filings.

4. If you decide to do the DIY route: Each month make sure that all transactions are reconciled to the business bank and credit card accounts, it is very import for tax prep purposes.

No QuickBooks Subscription?

If you are just starting out and you don’t have enough revenue to justify a QuickBooks subscription, Excel is an alternative.

Excel can be used to track revenues and expenses for businesses just starting out or having low volume of transactions. It doesn’t have to be anything fancy either, just a tab showing revenue, Expenses and a simple formula calculating net profit. Eventually, there will be a need to transition to actual bookkeeping software, but this can be sufficient for businesses just starting out with very low transaction volume.

Even if you plan to handle your own bookkeeping, I highly recommend getting a professional to set things up right from the start. It’ll save you a ton of headaches down the road. If you want help getting started, book a call with me, I’ll make sure your chart of accounts, and opening balances are set up properly, all while guiding you through what accounting method your business should use.

Hire a Bookkeeper

Honestly, you probably don’t want to do your books forever anyways. Your time is much better spent working on growing the business, rather than in the business. When you are ready to hand it off let’s talk, I’d love to help you take accounting off your plate so you can get back to focusing on your business.

Year End Tasks

One task specific to year end is prepping, filing and distributing 1099’s to all qualified vendors and non-employees that meet the requirements to receive a form 1099.

Pro Tip: As you onboard new vendors and suppliers require a completed W-9 form prior to first payment, this eliminates delays in form prep and filing.

At Year End, your bookkeeping will likely require a few adjustments. These are typically done through journal entries in the accounting software. If you are using excel, these transactions can get complicated so it’s best to let a professional accountant or your tax preparer handle them.

A good tax preparer will check to ensure everything is accurate for filing, but ensure your books are reconciled to bank and credit card statements.

Once everything is reconciled and adjusted, you can generate your year-end financial statements and hand them off to your tax preparer to complete the return.

Emergency Fund or Cash Runway

The last point I wanted to touch on is the importance of having an emergency fund or cash runway for unexpected expenses or events.

Revenue can fluctuate throughout the year, but many expenses such as equipment payments, insurance and payroll are fixed. Having cash on hand helps reduce stress during slower periods and ensures you can still cover your core expenses. For smaller businesses without rent or employees, I recommend 3–6-month reserve if possible. As the business grows, your cash reserves should grow too. For larger businesses with employees and rent I recommend at 6-12 months minimum cash on hand.

Need more accounting help?

Managing your company’s accounting can be intimidating, let me take that off your plate. We’ll handle your bookkeeping so you can focus on what you do best: running your business.

Ready to make it easier? Click the link below to book a call with me and lets level up your accounting